The sale of a business can be a complex and stressful time. Even once the deal is done there are still many financial aspects to work through, however, with proper planning, at least it is possible to reduce or even eliminate the impact of capital gains tax (CGT).

Where the business and sale have been structured appropriately, CGT concessions come into play. While the general CGT discount for holding a CGT asset for at least 12 months is widely understood, the Small Business CGT Concessions are considerably more complex in their application.

The small business CGT concessions are designed to allow business owners to tax efficiently realise the value of their business. This was considered particularly relevant as many business owners had not traditionally accumulated substantial wealth through the highly tax-effective environment of superannuation.

There are several Small Business CGT concessions:

- The 15 Year Exemption can apply to CGT assets held for more than 15 years and are sold in connection with retirement. This is the most valuable concession as it allows the entire capital gain to be disregarded and can apply whether a company’s shares are sold or the underlying CGT assets. Additionally, the benefit can be rolled into superannuation, up to a lifetime limit of $1,705,000 in 2023/24.

Where the 15 Year Exemption is off the table, the following concessions may still be available either separately or in combination:

- The ‘Small Business Active Asset Reduction’ allows for an additional 50% exemption to be applied to the capital gain remaining after the application of the standard CGT discount.

- The remaining capital gain can be further reduced by utilising the ‘Small Business Retirement Exemption’, which allows the capital gain of up to a lifetime limit of $500,000 to be excluded. Where the person is under 55 the amount excluded needs to be rolled into a superannuation fund.

- Where an individual is selling and establishing a new business, there is the ability to apply the Small Business Rollover to the remaining gain which sees the CGT event deferred. This can be an effective deferral, even where a new business or asset is not purchased.

Are you a “Small business?”

To qualify for the Small Business CGT Concessions, the business owner must meet the definition of a small business. Some of the basic eligibility requirements include:

Total net value of CGT assets owned do not exceed $6m. The assets of entities connected to and controlled by the taxpayer, will typically need to be included in this valuation. However, it excludes personal use assets, such as the family home or superannuation.

OR

The business has an aggregated turnover of less than $2m.

Getting advice

Eligibility and operation of the Small Business CGT Concessions can be very complex and will be impacted by the ownership structures of the business and as such it requires expert professional accounting and financial advice.

Your financial adviser should also work closely with your accountant to discuss the potential benefits of maximising superannuation contributions as well as provide an investment strategy which will provide for your future needs.

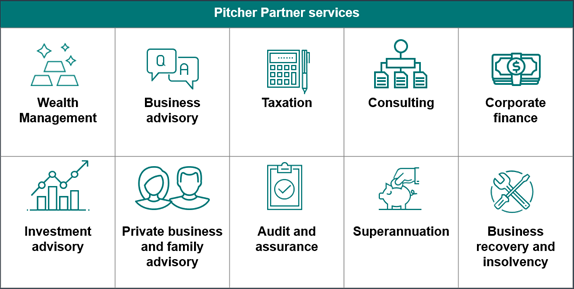

About Pitcher Partners

Pitcher Partners is an association of separate advisory firms located in Adelaide, Brisbane, Melbourne, Newcastle, Perth and Sydney. We provide a range of accounting and advisory services for business owners and their families including:

Disclaimer: Robert Prince (454 781) and Pitcher Partners Wealth WA Pty Ltd (1274651) (ABN 74 630 996 664) are Authorised Representatives of Sentry Advice Pty Ltd, AFSL 227748.

The information contained herein is of a general nature only and does not constitute personal advice. You should not act on any recommendation without considering your personal needs, circumstances, and objectives. We recommend you obtain professional financial advice specific to your circumstances

Robert PrinceStrategic Wealth Adviser

Robert PrinceStrategic Wealth Adviser